Invoice digitization is the process by which paper invoices are converted into a digital format, thereby transforming the way businesses manage their financial transactions with suppliers. This shift from paper to digital is part of a broader digitalization strategy for business processes, aimed at improving operational efficiency, optimizing costs, and enhancing data security.

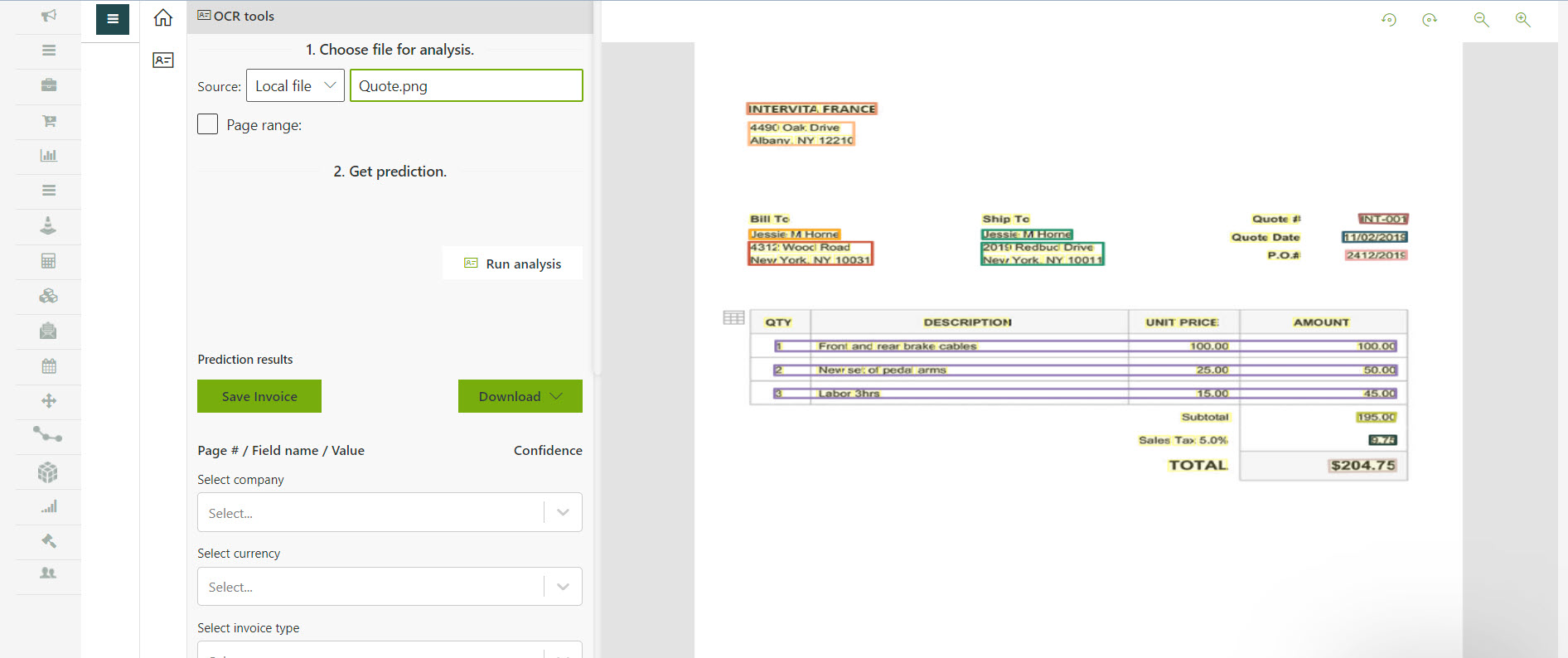

At the core of invoice digitization is the use of advanced technologies such as Optical Character Recognition (OCR) to extract data from paper documents, and Electronic Document Management Systems (EDMS) to archive digitized invoices securely and accessibly. These technologies allow invoices to be processed, stored, and retrieved much more efficiently than traditional methods, reducing processing times and minimizing the risk of error

The adoption of supplier invoice digitization by modern businesses goes beyond following a technological trend. It is a strategy that delivers tangible benefits, significantly improving operational efficiency and financial management. Among the most notable advantages are cost reduction and the enhancement of company efficiency and productivity, which are key motivators for businesses of all sizes.

Moreover, digitization promotes better visibility and increased control over the invoice management process. EDMS solutions and cloud platforms offer real-time access to invoices and associated data, facilitating financial analysis, planning, and strategic decision-making. This improved transparency and accessibility help minimize errors, quickly detect anomalies, and strengthen regulatory and tax compliance

One immediate benefit of invoice digitization is the substantial reduction of direct and indirect costs associated with processing paper invoices. This includes savings on paper purchases, printing costs, postal fees, and physical storage needs, which can be costly. Additionally, by automating invoice processing, companies reduce the time administrative staff spend on repetitive and error-prone tasks such as manual data entry, invoice verification, and archiving. This time savings allows human resources to be redeployed to higher-value activities, thus optimizing operational costs.

Invoice digitization also transforms internal processes, leading to a noticeable improvement in efficiency and productivity. Through the integration of automated systems, companies benefit from faster invoice processing, accelerated approval cycles, and reduced payment delays. This increased efficiency translates to better cash flow management and a strengthened ability to negotiate favorable payment terms with suppliers.

Selecting supplier invoice digitization software is a strategic decision for any company aiming to optimize its accounting and financial processes. To make the right choice, it is crucial to consider several essential criteria that will ensure not only the system's effectiveness but also its compliance and integration within the existing IT infrastructure.

To choose the right digitization software, several key criteria must be considered.

Assessing your specific needs in supplier invoice management is a fundamental step.

Compatibility with existing systems is a decisive factor to ensure successful integration and avoid additional costs related to infrastructure modifications.

Data security and compliance with local and international regulations are paramount.

Responsive customer support and appropriate training options are essential to facilitate the software's implementation and use:

Compliance with tax and legal standards is fundamental in the process of invoice digitization. Current legislation requires that electronic invoices be created, transmitted, received, and stored in a way that guarantees their integrity, authenticity, and readability. To achieve this, companies must adopt digitization systems that integrate advanced electronic signature mechanisms, digital certificates, and ensure digital archiving compliant with legal requirements. Adopting standards such as Electronic Data Interchange (EDI) or XML-based electronic invoicing can also facilitate this compliance.

Legal obligations vary from country to country but generally follow common principles in digitization. Companies must ensure that electronic invoices are accepted by the local tax administration and that these documents can be verified during audits. This often includes the need for a reliable audit trail, allowing tracing every step of the invoicing process, from invoice creation to storage. Regulations also impose specific retention periods for digitized documents, requiring secure and accessible digital archiving solutions.

In addition to regulatory compliance, invoice digitization offers significant fiscal benefits for companies. In many cases, governments encourage the adoption of electronic invoicing through tax incentives, such as tax reductions or credits. These benefits aim to offset the initial costs associated with implementing electronic invoicing systems and promote environmentally friendly practices by reducing paper usage. Moreover, digitization can improve the accuracy of tax declarations and minimize error risks, facilitating more efficient fiscal management and reducing the risk of non-compliance penalties.

Supplier invoice digitization is a process that involves several key steps to transform paper documents into digital formats while ensuring their authenticity, integrity, and compliance with current regulations. Two fundamental steps in this process are the scanning and conversion of paper invoices into electronic format, followed by electronic signature and authentication of digitized documents.

The first step in digitization involves converting paper invoices into a digital format. This is typically done using scanners that capture the image of the documents. Once scanned, invoices undergo an Optical Character Recognition (OCR) process to extract textual data from the scanned images. This process allows the information contained in the invoices to be transformed into editable and searchable data, facilitating their integration into Electronic Document Management Systems (EDMS) or accounting software.

This step is crucial as it establishes the foundation for digitization, allowing not only a reduction in necessary storage space but also improved accessibility and document management. Additionally, accurate conversion reduces manual entry errors and increases the efficiency of validation and payment processes.

Once invoices are converted into digital format, the next step is to ensure their authenticity and integrity through electronic signature. The electronic signature verifies the identity of the invoice issuer and ensures that the document has not been altered after its creation. It is an essential component for meeting legal and regulatory requirements, providing legally valid proof of the document's origin and integrity. Authentication of digitized invoices also involves applying security measures such as data encryption, which protects sensitive information against unauthorized access during transmission or storage. Together, electronic signature and encryption enhance trust in the digitization process, ensuring that electronically conducted transactions are secure and compliant with compliance standards.

Our supplier invoice digitization software is designed to transform and optimize the invoice management process within your company. With a suite of advanced features, our solution ensures effective and secure management of your invoices, from receipt to payment. Here are the main features that distinguish our software:

Our software automates the entire invoice management process, significantly reducing the time and effort required to process each invoice. From receipt, invoices are automatically sorted, validated, and routed to the right people for approval. This automation ensures reduced processing times and improved operational efficiency.

With our cutting-edge Optical Character Recognition (OCR) technology, our software accurately extracts data from digitized or electronic invoices. This automatic extraction of key information minimizes manual entry errors and accelerates the invoice validation process, allowing for smooth data integration into your accounting system.

Our solution is designed to seamlessly integrate with existing Enterprise Resource Planning (ERP) systems, facilitating data exchange between invoice management and other business functions such as purchasing, accounting, and customer relationship management. This integration ensures data consistency across the company and optimizes workflows.

Data security is at the core of our software. We employ advanced security protocols to protect the sensitive information contained in invoices against unauthorized access, data loss, and cyberattacks. Our solution also includes compliance features to ensure your invoice management meets current regulations.

By choosing our invoice digitization software, you benefit from a comprehensive solution that not only simplifies and speeds up invoice processing but also ensures their security and compliance, while offering detailed analyses for improved financial management.

By choosing our invoice digitization software, you benefit from a comprehensive solution that not only simplifies and speeds up invoice processing but also ensures their security and compliance, while offering detailed analyses for improved financial management.

Nous avons un réseau social dédié à la communauté NTIC. Si vous êtes inscrit ou souhaitez le rejoindre, cliquez sur le lien suivant www.axiscope.fr